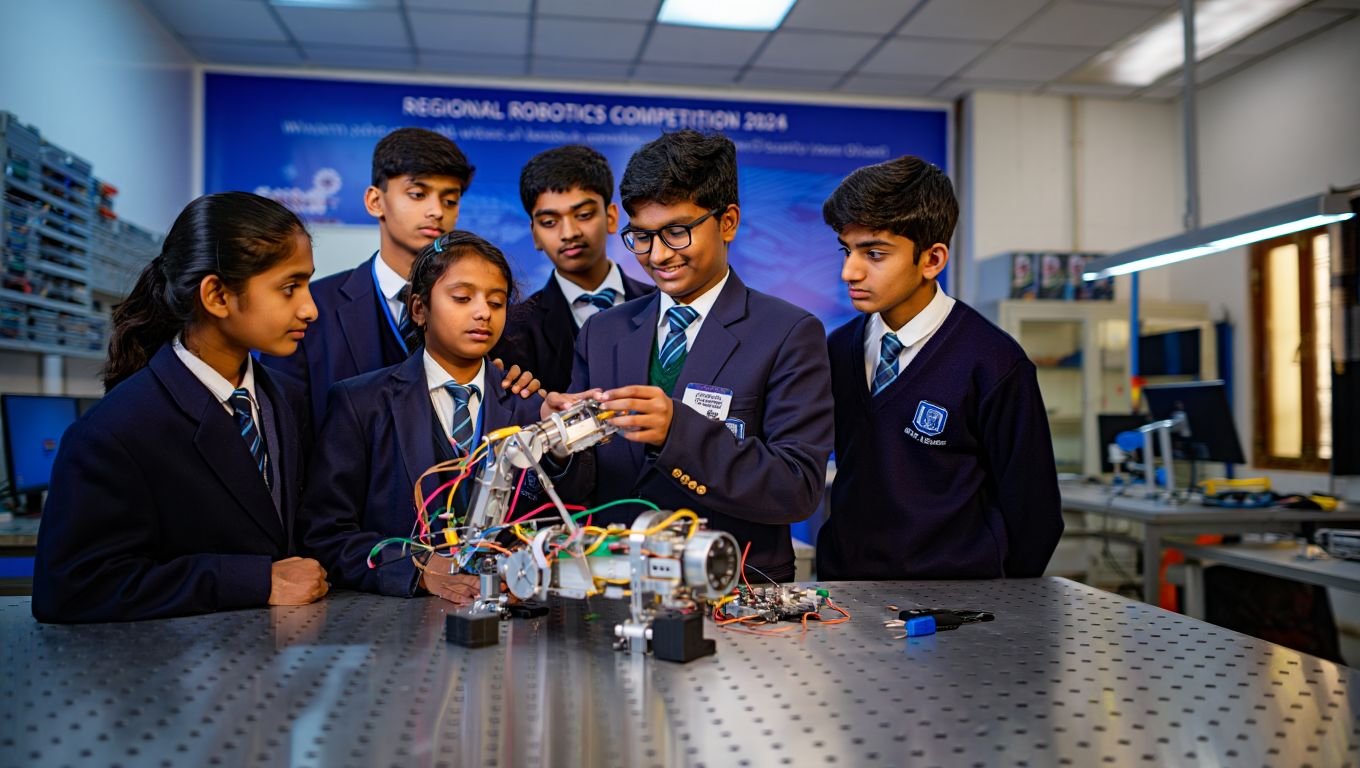

India STEM Foundation works to advance STEM education in India. To improve STEM learning opportunities, the India STEM Foundation actively collaborates with educators, communities, and students. To inspire the future generation of scientists, engineers, technicians, and mathematicians, India STEM Foundation runs a number of events, such as workshops, lab inaugurations, STEM competitions, mentorship programs, and resource creation. The foundation aims to equip young brains to take on real-world challenges and progress society by encouraging critical thinking, problem-solving abilities, and creativity.

India STEM Foundation The foundation works to close the skills gap between education and employment by promoting inclusive and equitable access to high-quality STEM education, eventually developing a trained labour force for India’s future with 21st century skills .The significance of science, technology, engineering, and mathematics (STEM) education cannot be emphasized in today’s quickly changing world. Investing in STEM education becomes critical as we embrace opportunities brought forth by technology breakthroughs and navigate through complicated problems. The India STEM Foundation is a leading organization in this mission, committed to developing the next wave of innovators and problem solvers. In this piece, we’ll look at the ways that tax-deductible contributions might help the India STEM Foundation fulfill its goals and help India have a better future.

The Importance of STEM Education

Companies understand how important STEM education is to developing a workforce with the skills necessary to meet the demands of the contemporary economy. To foster essential abilities like creativity, problem-solving, and technical proficiency, they aggressively fund STEM activities. Businesses view STEM education as a strategic investment for fostering innovation, accelerating growth, and boosting competitiveness because they recognize that personnel with STEM education are better able to innovate and adapt to technological changes. Because corporate participation in education plays a critical role in forming the next generation of innovators who will drive technical developments and affect the future landscape through STEM education, it is considered as a deliberate investment in the future.

Critical thinking, problem-solving, and technical proficiency are among the vital qualities that STEM education is vital in developing. This closely corresponds with the requirements of many businesses, encouraging creativity and flexibility among employees. Contributions that qualify for tax exemptions, such as 80G and supportive income tax deductions, help fund STEM education programs that train people for jobs in environmental science, technology, engineering, and healthcare. Strong problem-solving skills enable STEM graduates to effectively address professional issues, making them invaluable assets in fast-paced work situations.

Tax-Deductible Donations:

Contributions that are tax deductible in support of the India STEM Foundation’s mission help both the organization and the contributors directly. Donors might possibly minimize their tax responsibilities by claiming tax deductions on their contributions, which lowers their taxable amount. CSR donations are essential in creating a competent labour force, fostering innovation, and guaranteeing a better future for future generations by designating a portion of their taxes to fund STEM education programs. Contributions to supportive purposes, including STEM education, are further encouraged by donations that qualify for the 80G tax exemption and the charity income tax exemption.

Tax-deductible fundings are beneficial to the India STEM Foundation because they allow organizations and individuals to support the foundation’s objectives while receiving tax relief. Contributions that qualify for tax exemptions, such as those made under the supportive income tax exemption and the 80G tax exemption scheme, are essential to the foundation’s ability to continue its programs and grow.

Donors who make contributions to registered organizations, like India STEM Foundation, are eligible to claim tax deductions on their contributions under the country’s 80G tax exemption programme. This offers a reason for people and companies to back the foundation’s initiatives to advance STEM education in India.

The India STEM Foundation can efficiently deploy resources to empower the upcoming generation of innovators and problem-solvers via STEM education by utilizing the gift tax exemption, 80G tax exemption, and charity income tax exemption. Donors may confidently support the work of the foundation, knowing that their gifts will not only advance STEM education but also offer them tax benefits in accordance with Indian tax laws.

How Donation makes an Impact

The India STEM Foundation’s aim of enabling the next generation of innovators and supporting STEM education is greatly advanced by donations. Contributions enable the foundation to reach a wider audience, which is one way they have an effect. The India STEM Foundation can reach more students from a wider range of backgrounds by holding additional workshops, competitions, and mentorship programs with financial backing. This expansion guarantees that more young minds may explore their interests in STEM and have access to high-quality STEM education.

Donations also aid in the creation of cutting-edge learning materials. The foundation can make investments in the development of curricular improvements, digital platforms, and interactive learning resources that will improve students’ STEM learning opportunities. Donations to the India STEM Foundation also fund financial aid and scholarship schemes for students from disadvantaged families. These grants allow bright people to pursue STEM jobs regardless of their socioeconomic situation by removing financial barriers to study. This encourages inclusivity and diversity in STEM professions, broadening the talent pool by bringing in viewpoints from other backgrounds.

To Sum Up, The India STEM Foundation works with educators and communities to offer learning opportunities as part of its mission to advance STEM education. The development of abilities like creativity and problem-solving, which are essential in today’s economy, depends on STEM education. Companies understand this and actively support STEM initiatives because they see them as investments in competitiveness and innovation. Donations that are tax deductible, especially those with an 80G tax exemption, are essential to the foundation’s programs. By providing tax advantages, contributors are incentivized to make contributions, broadening the foundation’s audience and facilitating the provision of experiential learning opportunities and scholarships. These contributions enable kids to access high-quality STEM education, irrespective of their background, and thereby inspire the next generation of innovators. Donors can lessen their tax obligations while also supporting the foundation’s goal by using tax exemptions. By empowering future leaders in science and technology and investing in STEM education, we can work together to create a better future for India.